Webinar: Wealth management in BFSIWealth management in the increasing world of digital adoption, gamification and rising younger HNWIs

Webinar: Wealth management in BFSIWealth management in the increasing world of digital adoption, gamification and rising younger HNWIs

Digital Transformation in Wealth ManagementAn Overview from Celent’s Innovation & Insight Week 2021

Digital Transformation in Wealth ManagementAn Overview from Celent’s Innovation & Insight Week 2021

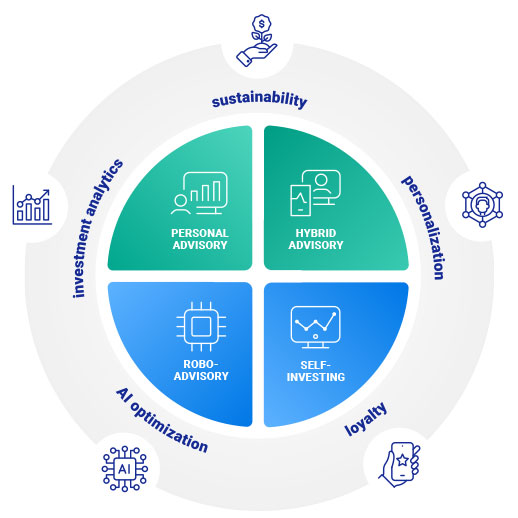

We support universal banks, private banks and wealth managers. And no matter if you handle retail, affluent or HNW customers – we will help keep your service at the highest level, any way you deliver it: through personal advisory, hybrid remote interaction, fully automated robo-advice or self-investing (DIY), all within a wealth management system.

Comarch Wealth Management software helps you deliver personalized and relevant wealth services by leveraging traditional human expertise with intuitive,multi-module and cloud enabled platform. Regardless of your organizational maturity, business scale and operational needs, the platform is the perfect match for you.

If your business is driven by relationship-building, or wealth managers for whom personal interaction with end-customers is of the highest importance, Comarch Wealth Management is here for you. With it, you can accelerate your internal investment processes and deliver excellent experience for your employees while keeping the personal advisory service customer-oriented and of the highest quality.

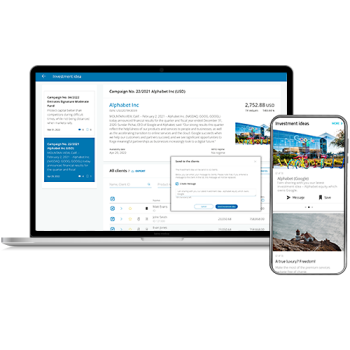

With Comarch, you are able to keep relationship-management-driven services at the center of your offering while you also pay attention to digital collaboration and communication between wealth managers and their customers. We can give you the advantage of your business model combining both high-touch and high-tech approaches.

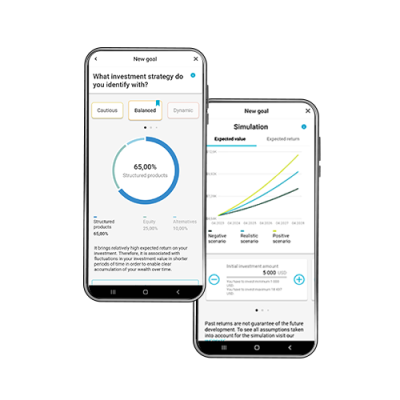

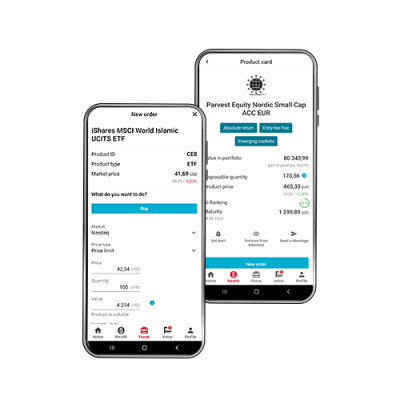

Customer channels and online offerings are an inherent part of the banking institutions’ strategy. Through those you can provide investment offerings to end-customers in a compliant and understandable way, that would also be automated, hassle-free and an enjoyable journey. Learn more

Acquire digitally savvy self-directed investors and provide them with best-in-class trading experience within a self-investing platform. Empower your existing customers with the right tools to increase their engagement. Retain customers and increase revenue without a large upfront cost.

Do you plan to make your wealth management offering ESG-oriented? Comarch Wealth Management software will help you assess customer preferences in terms of green products, offer sustainable product universe and analyze the actual impact the customer portfolio makes.

Is personalization one of the driving values in your business? Our platform supports various personalization aspects, starting from getting to know customer preferences, constraints and behavior, to offering personalized investment offering, curated content, and individual communication.

Do you want to strengthen your investment offering? Our optimization module will help you assess the potential of your product universe, bring insights that make you focus on the investments that really count, and make you include the optimal allocation of your products proposals.

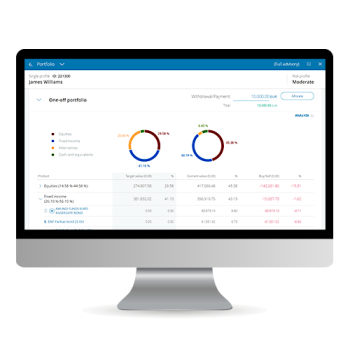

Do you struggle with delivering investment analytics that is comprehensive, transparent and hassle-free at the same time? Comarch Wealth Management software will take care of data aggregation, automate performance and risk analyses of customer portfolios, and deliver state-of-the-art investment reports.

Do you wonder how to engage your customers even more? Follow our philosophy of linking wealth management with loyalty flavor, by rewarding customer behavior, making special offers to most active end-customers as well as granting loyalty statuses and scores that drive customer engagement.

Comarch Wealth Management platform supports banks and wealth managers across the globe at various time zones and regulatory frameworks. Each one is unique, but all excellent when it comes to creating the definitive wealth management software.

With mobile Comarch Wealth Management Client Front-End you can better guide your customers towards financial discipline. Thanks to tailor-made investment ideas, notifications, or automated rebalancing, end-customers are always up to date with growing their wealth – and know how to grow it themselves.

Retail bank, Europe

800+ advisors | 1M+ customers | 50+ EUR AuM

Strategic goals

To scale up advisory services delivered to retail customers

Deliverables

A personal advisory capability given to the bank’s agents, to help them deliver investment proposal

Key results

A significant increase of advisory meetings with customers and boost of sales of third-party products

#mifid2 #omnichannel #straightthroughprocessing

Comarch Wealth Management consolidates end-customers wealth picture and portfolio performance in one place to improve advisors work. Comarch Wealth Management system prioritizes your advisors’ tasks and activities and provides them with guidance, minimizing the risk of human error.

Universal bank, Middle East

100+ advisors | 4,000+ top segment customers

Strategic goals

To deliver state-of-the-art investment reports and data consolidation

Deliverables

A 360-degree customer representation and automated investment reports

Key results(s):

A fully automated investment reporting process, on-click customer insights availability consolidated from fragmented data sources

#islamicbanking #investmentaalytics #investmentreporting

We believe everyone should be provided with the investment advice that suits them best. Comarch Wealth Management software lets you adjust your recommendations to customers’ risk appetite, knowledge or objectives – all based on their up-to-date financial picture. All in a single wealth management system.

Universal bank, private banking division, Europe

Numbers: 100+ RMs, 10,000 customers, 7 countries

Strategic goals

To standardize RM experience across all countries and digitize investment services in self-service channels

Deliverables

Hybrid advisory enabling the bank to prepare personalized investment offering and deliver it in a fully digital way

Key results

Increased number of interactions with customers, higher offering conversion, time savings and high quality data for RMs

#mifid2 #hybridadvisory #personalization

Comarch Wealth Management’s own end-to-end advisory process – from customer onboarding, through portfolio building, up to reporting – will make your job much easier. We amplify operational efficiency, resulting in cost reduction, time savings and additional generation of business.

Universal bank, Asia

Numbers: 800+ agents, 300,000+ customers, 3 segments

Strategic goals

Onboarding of mass and affluent customers to the bank’s investment services

Deliverables

Personal advisory supporting the bank’s agents in selling own funds and APIs supporting customer’s channel

Key result(s):

Shortening the time for customer assessment and advice, higher penetration of investment products in underinvested segments

#affluentsegment #modelportfolios #clientchannel

Tell us about your business needs. We will find the perfect solution.